The Best Way To Setup A Merchant Account!

Why is the Interchange Plus pricing so superior to tier programs?

-Transparent Pricing

-Understand why transactions downgrade

-Identify missing transaction data

-On refunds receive interchange credit

-Interchange Optimization Tools

-Monthly billing which makes accounting a snap

-World Class 24/7 phone support

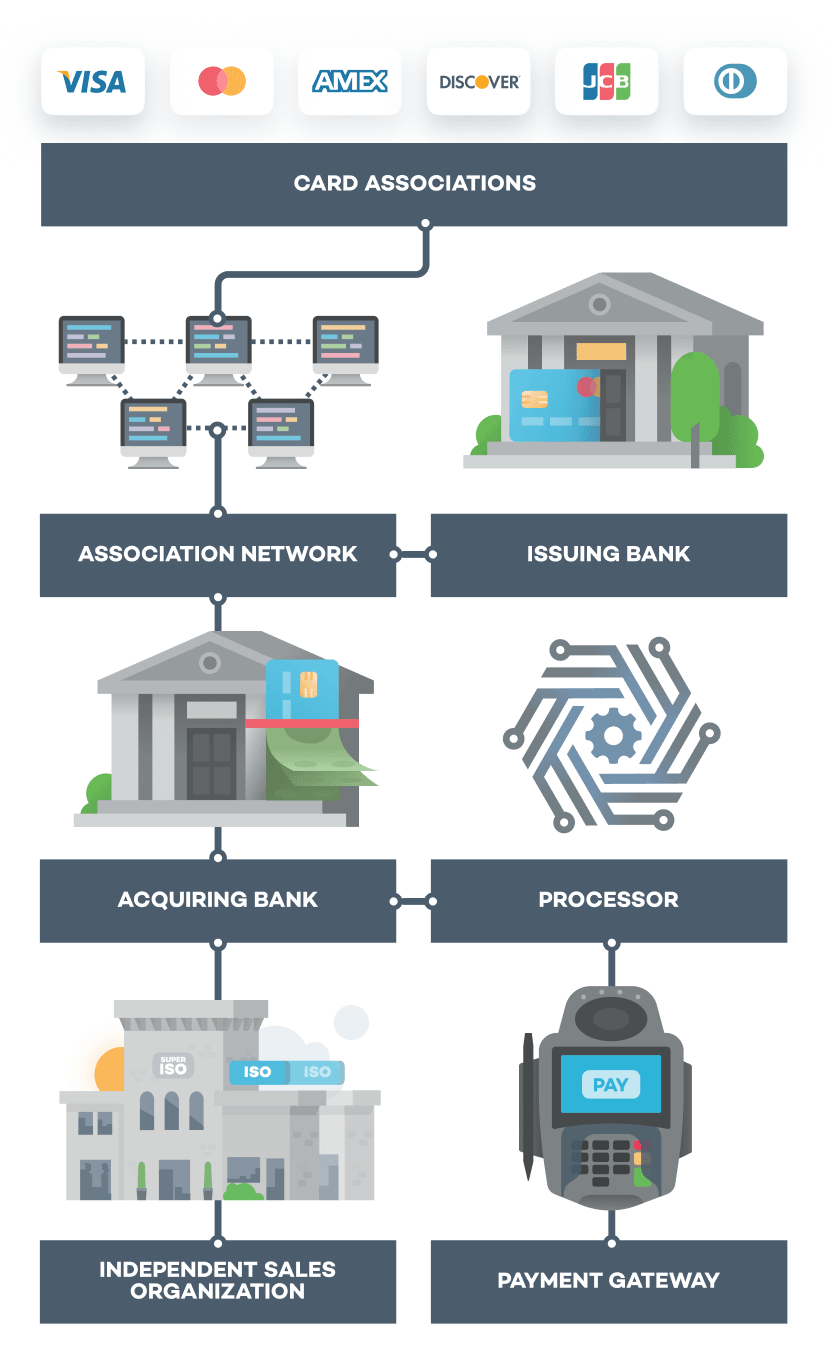

How Credit Card Processing Works

How transactions are processed

1. The CARD ISSUING BANK this is the bank that issued the credit card. Example Chase Bank®, Wells Fargo® or Bank Of America®

2. The ACQUIRING BANK is the processor that communicates to receive an authorization on a credit card.

3. The PAYMENT BRANDS are Visa®, MasterCard®, Discover® and Amex®.

Know who makes what portion of the total fees collected from your merchant account.

Interchange Plus Pricing vs. Tiered Pricing

Throughout the industry it is common to find merchant service providers advertising flat percentage rates for tiered pricing. In fact, I see television commercials or come across websites that have flat rates advertised without the company having any information about the merchant, products and or services being sold and the type of business. Something else I have noticed, is that I have yet to find a merchant service provider that addresses interchange pricing.

What is interchange pricing and why is it important?

The card issuing bank now comes into play because the banks set up interchange rate charts that are tied to the customer's credit card. So, when the transaction is performed a rate applies to that card. Now is where the issue of a flat tiered rate or interchange pricing comes into play. If a merchant is setup on a flat tiered rate plan, the transaction defaults into one of three tiers. If the merchant account is *setup under interchange pricing then the merchant pays a pre-determined amount above the rate tied to that credit card.

There are more than 1000 interchange rates in the market today. If your business is a coffee shop or a utility business, different interchange rates apply to different businesses. Coffee shops sell small ticket items and can qualify for a small ticket interchange rate which has a lower transaction fee and discount rate which will save money when running a lot of transactions, a utility company has no discount rate to pay but just a transaction fee to run a transaction. Merchants that are setup on tiered program will not get these savings, which makes your bottom line more expensive. If merchants only ask what is my percentage rate, they are not taking into account the entire cost of having a merchant account and will be surprised when they receive their first processing statement. All of these factors will affect the fee structure that the merchant is charged when a credit card is accepted. This is why it is critical that the merchant understands what interchange levels are and how they affect their pricing. If a processor quotes a flat tiered rate, the merchant will not get to take advantage of the actual interchange rates that applies to each transaction. Every card will have the same flat percentage rate applied. In the long run, this can add up to hundreds or thousands of dollars in fees that the merchant must pay. With interchange plus pricing there is no way to pad the rates or put lower rates in a higher tiers.

What happens to your Credit Card rates over time?

How do I know if I am being charged a tiered rate?

Qualified Rate – A swiped card in a retail location.

Mid-Qualified Rate – A rewards cards, keyed in transaction with address verification.

Non-Qualified Rate – A keyed in transaction without address verification, a commercial credit card or a foreign issued credit card.

What happens with a tiered pricing program is that there are essentially three pricing buckets and each bucket will get 30 or more interchange rates bundled into a specific tier. Regardless of the interchange level that applies to the credit card, it will default to the next highest level so that the processing bank does not lose money on a transaction. So, a rewards card has a higher interchange rate than a debit card. No matter how the transaction is processed, the rewards card automatically defaults to the Mid-Qualified rate even if it was a swiped transaction causing the merchant to pay a higher fee. The merchant will not typically know that this is the case because the monthly statement usually does not list this level of detail. These statements tend to hide the fees through inconsistent categories, surcharges, past posting and hidden costs.

With Interchange Plus pricing, the merchant will get charged the actual interchange rate plus the mark-up margin. For example, if a merchant pays 25 basis points above interchange and they process $10,000.00 at a particular interchange level, then the merchant knows they are paying $25.00 in actual credit card processing fees. Additionally, the monthly statement will contain these transparent details. As a business owner, you can forecast and budget for the amount of the actual fees and price your products and/or services accordingly.

This presents an opportunity to the business owner to educate themselves as to how certain transactions are processed and why. If certain transactions are not being processed correctly to take advantage of the best rate, then a business owner can teach their employees how to do it correctly to save on fees. This takes more time and energy on the front-end, but it can literally save you thousands of dollars in processing fees.

This is the way that large merchants have had their credit card processing fees assessed for many years. Now, it is possible for small to mid sized merchants to take advantage of this pricing as well. GDpay is a company that is leading the way in educating business owners about interchange pricing and how it can benefit their bottom line. Contact an agent at GDpay for more information today!

Emerging Market Processing Programs

Emerging Market Processing Rates

What Business qualify for Emerging Market rates?

Fines MCC 9222

Cable MCC 4899

Subscription Marketing MCC 5968

Propane, Fuel Oil, Wood, Coal MCC 5983

Child Care Services MCC 8351

Schools, Colleges MCC 8211/8220/8299

Government Services MCC 9399

Charitable Organizations MCC 8398

Insurance Company MCC 5960/6300

Marketing, Sales, Underwriting, Premiums

Utilities MCC 4900

Propane delivery, Gas, Water, Refuse removal

Fines MCC 9222

Cable MCC 4899

Bridges and Road Fees, tolls MCC 4784

Bail and Bond Payment MCC 9223

Transportation MCC 4111

Schools/Colleges MCC 8211/8220/8299

Government Services MCC 9399

Tax Payments MCC 9311

Postal Services Government MCC 9402

Utilities MCC 4900

Fuel Oil, Wood, Coal, Propane delivery, Gas, Water, Refuse removal

What Credit Cards Qualify for Emerging Market Rates?

-CPS Retail

-CPS Card Not Present

-Electronic Commerce Basic

-Electronic Commerce Preferred Retail

-Retail Key Entry

-Signature

-Infinite

-Rewards

-Debit (Check Card)

Business-to-Business Processing Program

Interchange Optimazation

-Customer Profile & Managed billing

-AJAX Tokenizer with P2PE

-Easy to use RESTful API

Business-to-Business Credit Card Processing Rates with Level 2 & 3 data

Visa and MasterCard has created a special Business-to Business (B2B) and Business-to-Government (B2G )interchange category that offers lower processing rates on all Visa business, commercial, purchasing and government credit card transactions. The B2B rate can be any where to 0.50% to 0.75% percent lower that a merchant pays for interchange or more than the normal processing rates offered to other industries. GDpay has a list of eligible industry types that can take advantage of these savings. The B2B rate will reduce your monthly processing fees by an average of 10-20%. When processing large transactions over $5000, GDpay can help you reduce your interchange fee even more by passing extra data.

Large Ticket Credit Card Transactions

Many businesses need to process credit card payments that average over $5,000 per transaction. The Card Associations (Visa) have specific interchanges that address these requirements which minimizes the costs of processing theses transactions. Businesses that qualify in this category often process transactions capturing level 2 and level 3 data for corporate and government cards. Level 2 data is designed to support B2B credit card transaction, since the majority of the cards accepted in this environment are corporate cards. Level 3 data is designed to support business-to-business and business-to-government payment processing, the majority of the cards accepted in this environment are corporate and government cards.

What Data is needed for level 2 &3

Level 2 Data

-Standard Information - Credit card number & expiration data, billing address, zip code & invoice number

-Customer Code - Isn't required but encouraged to be captured

-Sales tax amount must be submitted separate from the total transaction. Certain rules apply to the amount.

Level 3 Data

-Standard Information - credit card number & expiration data, billing address, zip code & invoice number

-Customer Code - is not required but encouraged to be captured

-Sales tax amount must be submitted separate from total transaction.

-Freight amount if applicable and can equal zero

-Duty amount, if applicable

-Product/Item ID (product/service)

-Product/Item description

-Product Quantity

-Product/Item amount

-Unit of measure

Convenience Fees & Surcharging Credit Cards

Accept Credit cards without incurring fees

-Capture additional revenue from impulse buyers

MasterCard® Rules on charging a fee

MasterCard states that any convenience fee must comply with the following:

-Must be properly disclosed to the cardholder in advance

-Cannot discriminate against or discourage use of the MasterCard cards or brand in favor of any payment acceptance brand deemed by MasterCard to be a competitive brand, including American Express, Discover, and Visa

-Doesn’t have to be assessed on cash, check, automated clearinghouse (ACH), or personal identification number (PIN) based debit payments

-Can be assessed as either a flat per transaction fee, a variable or tiered rate fee based on the amount owed, or a fixed percentage of the amount owed.

-Elementary and secondary schools for tuition and related fees and school- maintained room and board

-Colleges, universities, professional schools and junior colleges for tuition and related fees and school-maintained room and board

-Local, state and federal courts of law that administer and process court fees, alimony and child support payments

-Government entities that administer and process local, state and federal fines

-Local, state and federal entities that engage in financial administration and taxation

-Government services - merchants that provide general support services for the government

-Additionally, MasterCard (unlike Visa) will permit a variable convenience fee to be assessed in connection with Debit MasterCard® transactions in card acceptor business code (MCC) 9311—Tax Payments. Also, note that Visa allows only a fixed or flat convenience fee payment amount, unlike MasterCard which allows a variable fee.